Quote

"He who loses money, loses much; He who loses a friend, loses much more; He who loses faith, loses all." - Eleanor Roosevelt

Seems fitting right about now...

Picture Perfect

Today's piece is going to be light on words and heavy on images.

It's easy for people to read "buy the dip" and "be greedy when others are fearful." But as human nature has it, these concepts become hard to follow when your brokerage account is brighter than a midnight red light.

When you see an image of a concept it's almost as if you could touch it, your eyes build the example in your brain. That's the goal of this email.

So to reinforce the investor code, here are 7 images that could save you thousands.

1) Politics and Investing

The media will tell you differently, but over the long term who is in office has little effect on what the market does.

2) The Cycle of Market Emotions

These repeat time and time again. Where are we now? That's for you to decide.

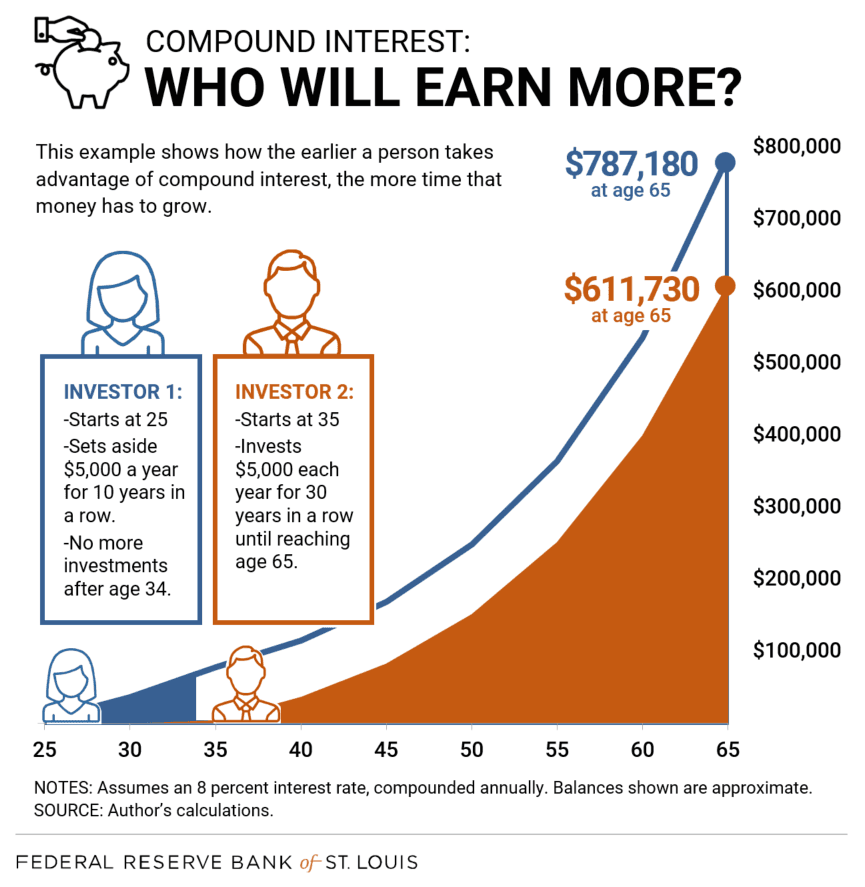

3) Power of Compound Interest

The importance of investing as soon as possible is highlighted by this image.

$5,000 a year = $416 a month.

If you'd like, here is an investing calculator to run your own numbers.

4) Stocks Bottom First

The S&P 500 is represented by the blue dotted line. As you can see, the S&P has been the first to bottom in "crisis" periods.

I came across these charts on Michael Batnick's website. If you want to hear him discuss how this compares with current market conditions check out the post here.

5) Companies That Own Brands

You can often track multiple of your favorite brands back to the same company.

6) Bull vs Bear Markets

A timeline of bull and bear markets (there is a lot more blue).

The average bull market lasts 2.7 years.

The average bear market lasts 9.5 months.

7) A Reason To Sell

It doesn't matter what time frame you look at, there has always been a reason to sell.

Conclusion

That's all for today.

Next time you are thinking about doing something irrational with your investments (*cough loading up on call options *cough) remember these images.

Till next time, Cade.

P.S. None of these images belong to me. Shout out to the original creators!

What I Liked This Week

From Oculus To Military Weapons - Podcast interview with billionaire Palmer Luckey and what he has done since selling Oculus for $2 billion.

Side Business Guide - Email by Justin Welsh on his two favorite ways to start a side business.

Best Of The Best

Enjoy this post? I'd appreciate it if you share it with friend. Thanks, you're the best.

Nothing in this email is intended to serve as financial advice. Do your own research. If you have any questions, comments, suggestions, etc. about the email send me a DM on twitter. See you soon!