Quote

“There is only one success – to be able to spend your life in your own way.” - Christopher Morley

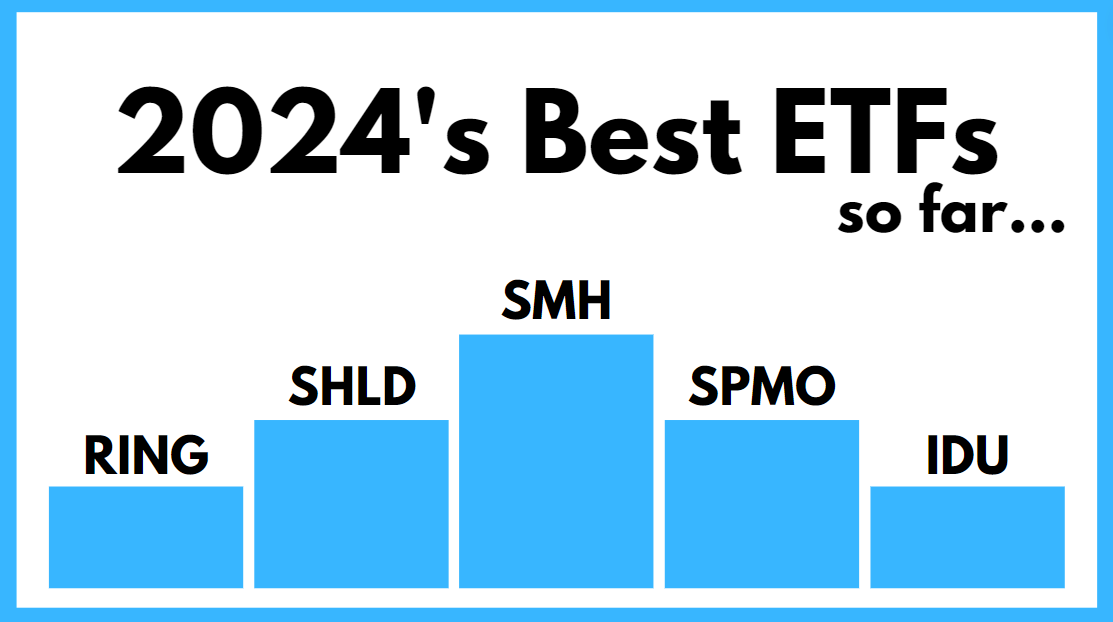

ETFs To The Moon

Did you blink? Because it’s already August and the market has been off to the races.

We all keep up with the usual ETFs like VOO and QQQ, but are there any other funds you should be paying attention to this year?

To help answer that question here is a list highlighting five of the best performing ETFs so far in 2024.

Let’s find out which are worth your money 👇

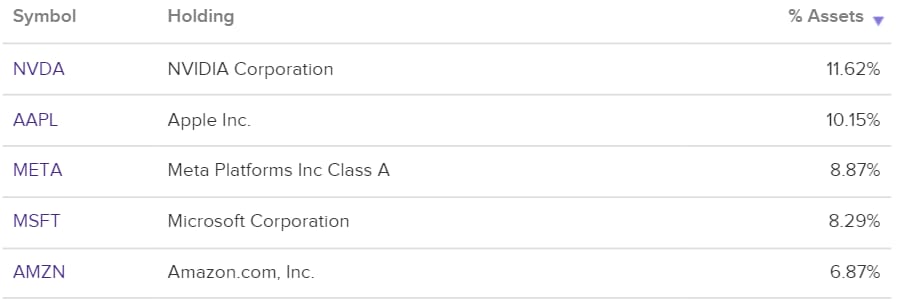

SMH - VanEck Semiconductor ETF

Summary: We all know the story with semiconductors here recently…up and to the right. SMH is a semiconductor ETF that tracks the overall performance of the 25 largest, US listed companies that manufacture semiconductors.

With only 25 holdings it is quite concentrated, but for those who find the semiconductor industry challenging to understand (myself included) SMH offers broader exposure.

Personally, I bought a small amount of this ETF two years ago and kind of forgot about it. It’s had a heck of a run up, so I’m being patient before buying more.

Expense ratio: 0.35%

Assets under management: $20MM

Year to date performance: +39%

5 Year average performance: +33%

Top 5 holdings:

SPMO - Invesco S&P500 Momentum ETF

Summary: For those who haven’t heard of “momentum” ETFs they are essentially funds that pick their holdings based on recent performance. If there was an ETF class for band wagon investors, momentum ETFs would be at the top of the list.

SPMO in particular tracks 100 of the S&P 500 stocks that have had the best recent performance. Over the last 5 years it has averaged an annual performance of 17% beating out its first cousin the S&P 500 that has averaged 14%.

On top of that, the drawdowns for SPMO were actually less than the benchmark and the expense ratio isn’t terrible. I’m keeping this one on the radar.

Expense ratio: 0.13%

Assets under management: $1,256M

Year to date performance: +32%

5 Year average performance: +17%

Top 5 holdings:

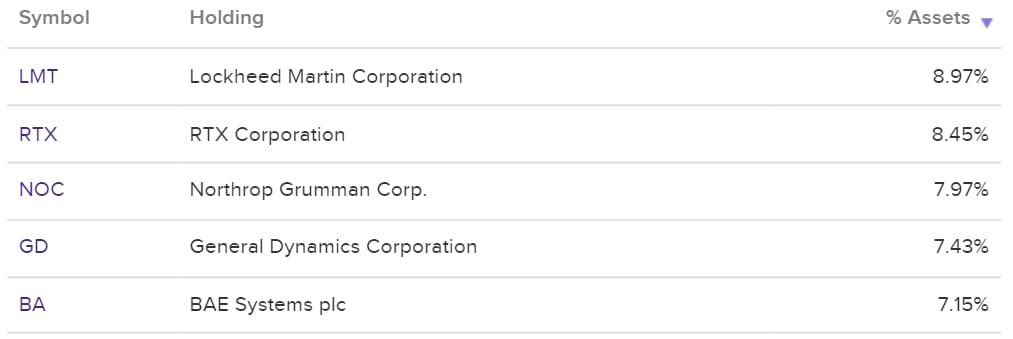

SHLD - Global X Defense Tech ETF

Summary: It is no secret that the US has one of the largest and most powerful militaries in the world. At the bottom of the funnel to collect the trillions of dollars being throw at missiles, stealth aircraft, and general weapon development is defense companies. Let’s be honest, this government spending isn’t going anywhere anytime soon.

SHLD is an ETF that tracks a market-cap weighted index of 50 companies around the world that are directly tied to the defense technology sector.

The expense ratio is high, but for those who don’t want to keep up with individual companies and specific government contracts this ETF might be worth considering.

Expense ratio: 0.50%

Assets under management: $404M

Year to date performance: +29%

5 Year average performance: N/A Inception in 2023

Top 5 holdings:

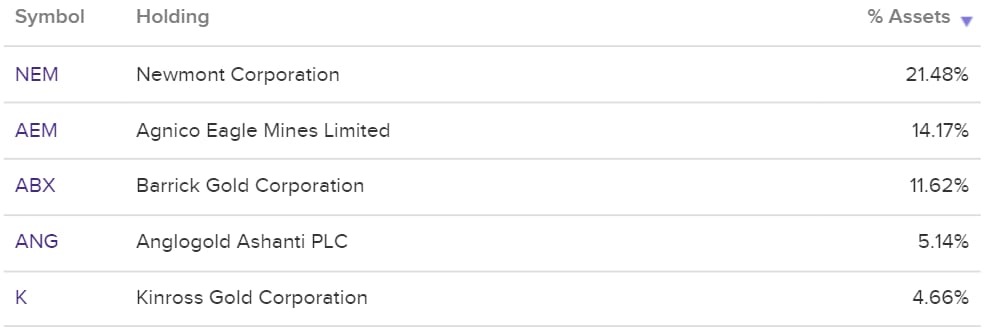

Summary: If you are like me you likely didn’t expect a gold ETF to be on this list. RING though has found itself among the best performing ETFs in 2024 by offering investors exposure to some of the world’s largest gold mining companies.

As you’d expect, the performance of this ETF is heavily tied to the overall price of gold. Valuable metals have been seen as important for a long time. Here is an interesting post titled “Why is Gold Valuable?” for those who want more background.

(I can already see the Bitcoin bros emailing me after seeing this ETF on the list)

Expense ratio: 0.39%

Assets under management: $541M

Year to date performance: +28%

5 Year average performance: +7.3%

Top 5 holdings

Summary: Thought a gold ETF was as boring as it would get? Let me introduce you to the utilities sector. While boring, no one can question the need for power, water, trash services, etc. Even in a recession, you will still be paying for the lights to be on in your house.

IDU measures the overall performance of the US utility sector which has underperformed the S&P 500 over the last five years. On another note, VPU which is Vanguard’s utility ETF has performed extremely similar to IDU long term and has a significantly lower expense ratio.

Overall, the utilities sector is great for those seeking respectable dividends and stability for their portfolio but there are better options long term than IDU.

Expense ratio: 0.40%

Assets under management: $1,300M

Year to date performance: +19%

5 Year average performance: +6.8%

Top 5 holdings

Conclusion

Every year I like to take a little time to see which ETFs are performing the best as it’s an opportunity to learn about new funds. This time I figured it was worth sharing so hopefully you learned about a new ETF or two!

Remember to always do your research when it comes to holdings, expense ratios, investment strategy, historical returns, etc. Not all ETFs are created equal.

Keep ETF’n ~ Cade

Don’t miss the next email 👇

Chump Change Picks

12 Money Tools - I used ETFdb.com to pull most of the ETF information for this post. If you’d like to know about 11 other handy tools here is a free PDF with the best ones I have found over the last seven years of investing.

The Joint Account - Here is a new newsletter I stumbled across written by Doug Boneparth that helps couples discuss money. Being recently engaged, there were some really good nuggets across a few of the articles I binge-read.

Stocks Have Been Chill In 2024 - Cool image showing how non-eventful the recent market drop was when compared to events over the past couple years. Not to jinx it, but this year has been pretty mellow.

Best Memes

Who’s with me?

Mood last week when the market tanked.

What did you think of the content?

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email don’t hesitate to send me a reply.