If you are not a subscriber, join 1,520 other individuals who read my personal opinion on investing, personal finance, and business. (And they enjoy good memes.)

While wishing my grandma a happy mothers day on Sunday she brought up how their retirement accounts were being hit and “haven’t looked this bad in years.”

It’s officially ugly out there folks and there is no dancing around it.

Last week we saw the market punch it’s biggest single day loss since 2020.

While it’s hard to keep buying when your portfolio is getting whacked every day, that’s exactly what I’m doing.

Last week I added to QQQ in my normal brokerage account and VUG in my Roth IRA. My reasoning behind adding to these is simply because they are being hit the hardest right now. QQQ is down 25% year to date while VUG is down 26%. These are my main growth positions and are discounted from where I was buying them 6 months ago.

So are we witnessing the popping of a bubble?

Brought to you by Torto.ai

Torto.ai is a new and up-and-coming investment research platform made for investors, by investors.

You know the struggle of clicking through fifteen different tabs trying to find all of the metrics for that new stock or ETF you want to buy. Torto.ai aims to solve that problem by providing access to reliable and professional data for over 10,000 stocks all in one place.

Their AI assistant also provides personalized insights to assist your portfolio including performance and risk factors, potential new assets, and interesting statistics.

Torto is currently in the beta version and adding new features at a rapid pace.

The best part? Use the code “cadeinvests20” to get a 20% discount on all subscription plans.

“As sure as the spring will follow the winter, prosperity and economic growth will follow recession.” - Bo Bennett

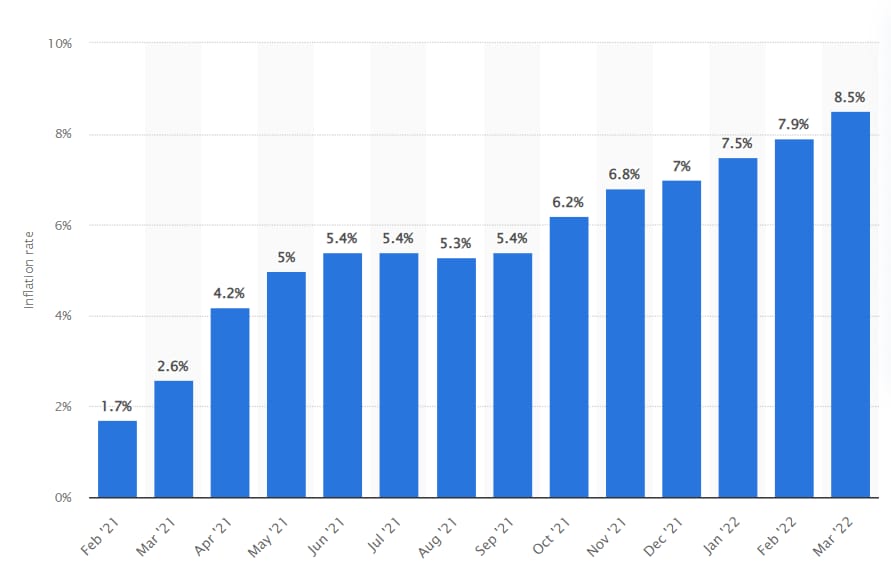

It’s not breaking news that we have seen record-breaking inflation over the last few months. The CPI (consumer price index) for March put inflation at 8.5%, the highest it has been in 40 years. You’ve likely seen this reflected in rising prices, especially if you drive a gas-guzzling truck like me and kiss $100 goodbye in a minute at the pump.

The inflation data for April is scheduled to release tomorrow (May 11th) and will have a major impact on what the markets do.

To combat this inflation, the Federal Reserve raised its benchmark rate a half point last week and also stated more half-point increases can be expected.

For those who don’t know, the Federal Reserve is the central bank of the U.S. responsible for overseeing the economy and controlling the money supply. One of the ways you do this is, you guessed it, by adjusting interest rates.

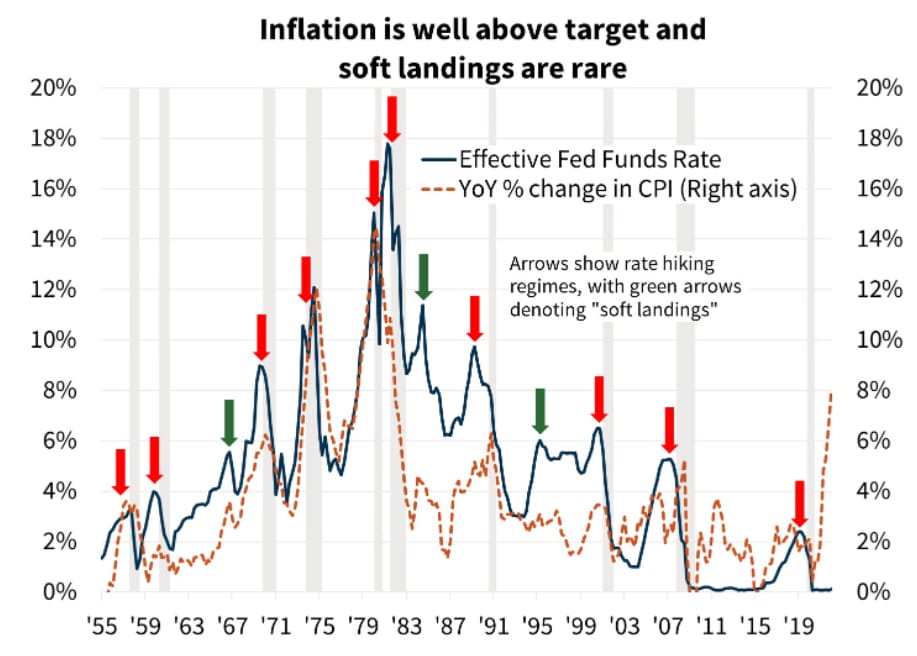

So can the Fed assure us a “soft landing” or will they force us into a crash that goes down in history as The Great Fed Bubble of 2022.

The Fed’s plan is to slowly raise interest rates and allow inflation to come down while simultaneously not crashing the economy. Unfortunately, history suggests that this might be a Spirit Airlines landing.

Out of the last 13 rate hike cycles, 10 of them have led to a recession.

So with the Fed adding basis points like I add partial credit to my homework, we can only hope the economy holds on. Many financial institutions are calling for a “modest recession” later into 2023. If it does occur it would impact everything from housing prices to employment rates.

At the moment the Fed is projecting inflation to have peaked in March and has a goal of 4.3% by the end of the year. The CPI data for April will be very telling if this is achievable. If we see a number above 9%, it’s likely the market will continue to sell off, but if it decreases from March’s 8.5% or even stays the same, there might be a shot at landing this bird “softly.”

Conclusion

The Fed needs to get inflation under control. Though at the moment I don’t think they would be against crashing the market if it came down to it.

As usual, I am continuing with my regular monthly contributions. I’m not in the business of calling a bottom and would rather average in on the way down than miss a 10% bounce.

That’s all I have, expect an email in the next week or so explaining how rising interest rates affect your everyday life.

Till next time, Cade.

Resources:

M1 Finance - Open an account and get $50 free when you make a deposit of $100 or more.

Simply Invest With ETFs - Learn the in’s and out’s of ETFs and why they are the simplest and most effective way to invest.

Turbocharge Your Dividends - Generate extra income by selling covered calls on your stocks and ETFs.

Tweet Hunter - Automate your Twitter and build an account that will pay you $100 a week.

Personal Capital - Track all of your investments in one place.

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email send me a DM on twitter. See you soon!