For those who love coffee and capital markets, stock mugs are finally here! ☕

I have limited stock with no plans yet to re-order.

That said, as a Chump Change reader this is your chance to snag a mug before they get posted on X.

Quote

“Having a large amount of leverage is like driving a car with a dagger on the steering wheel pointed at your heart. If you do that, you will be a better driver. There will be fewer accidents but when they happen, they will be fatal.” - Warren Buffett

3x Up, 3X Down

Triple digit returns, extreme leverage, and the hope of getting rich.

With the stellar performance of the market over the last decade leveraged ETFs have become more and more popular.

Earning two or three times the average market return sounds great, but these funds have a dark side that many fail to recognize before investing.

Here is how these high risk funds can make you rich (or broke) faster than any other investment.

1) How It Works

For this post we are going to focus on a single fund TQQQ - ProShares UltraPro QQQ (triple leveraged ETF).

TQQQ works by returning 3x the daily return of QQQ. Daily is the key word as this does not equal 3x the weekly, monthly, or yearly returns of QQQ.

As an example, if you invested $100 and the QQQ went up 5%, your investment would now be worth $105. The same $100 invested in TQQQ would now be worth $115.

Unfortunately, this also works in the reverse.

On a 5% down day your investment in QQQ would be $95 while your investment in TQQQ would be $85. Remember this phenomenon as it will be important later…

2) Historical Performance

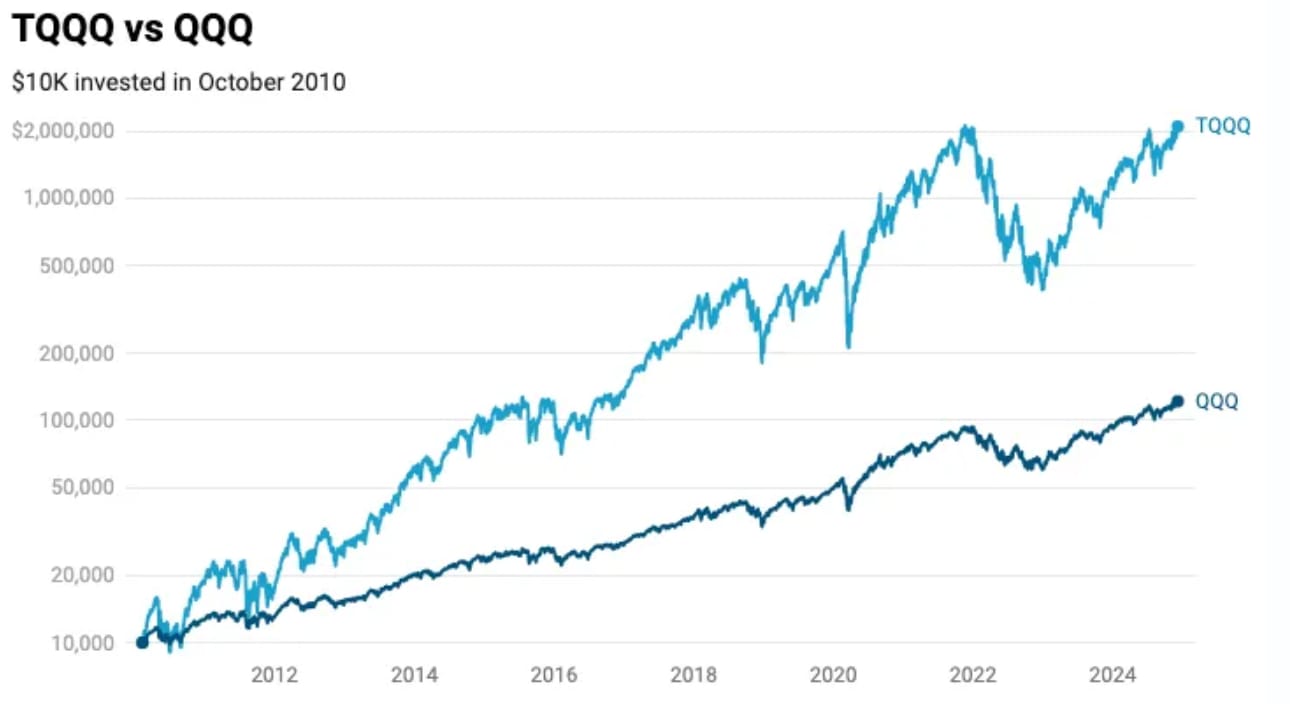

I almost didn’t believe this the first time I read it, but $10,000 invested in TQQQ in 2010 would now be worth ~$2,000,000.

How is this possible?

It is hard to comprehend, but leverage + compound interest is a crazy animal when things are going in the right direction. In the last 10 years TQQQ has averaged a 30% annual return compared to QQQ’s 17.6% average.

As it happens, TQQQ has only been around since 2010 (which coincidentally is the time when QQQ kicked off its historic run). Timing and luck play a factor, but the numbers don’t lie on what this fund has done in recent history.

So why don’t we all buy TQQQ and go retire in the Bahamas?

3) Risk of Ruin

While the recent decade has been the TQQQ show, when we wind back the clock there is a history that does not promise white sand beaches and lambos.

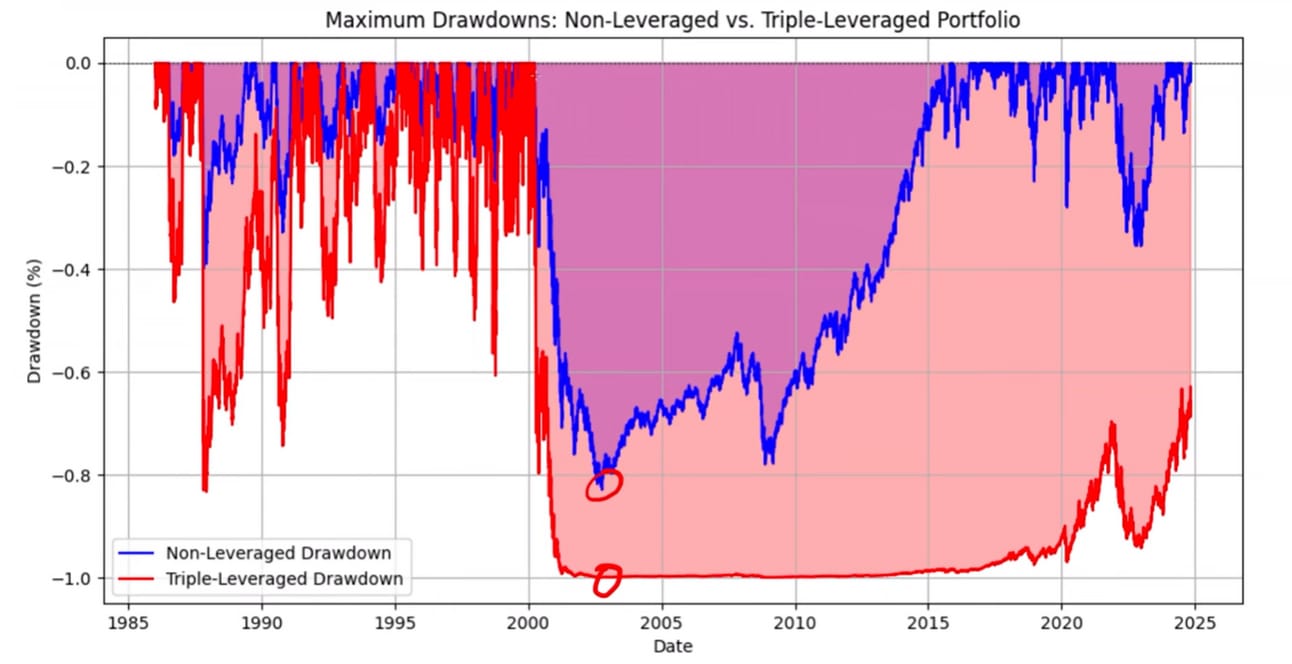

Due to how leverage works, your down days (or years) can be much worse. The 3x factor working on the downside makes TQQQ exponentially more risky as there is a very real chance of your investment going to zero.

TQQQ has only been around since 2010 but the chart below shows the max drawdown performance as if it existed since 1985 (red line). If you bought at the all time high, and held for 25 years, you would still be down over 65% even with the Nasdaq’s recent performance.

The TQQQ performance we see today starts in 2010 (and looks great). This graphic does a good job of putting into perspective how the narrative would not be the same if it had existed in the good’ole days.

If you want more graphic based explanations of TQQQs performance, click here to watch the video of Nathan Winklepleck explaining more charts like the one above.

Conclusion

While it is fun to day dream about the possibility of leveraged ETFs turning a “small” investment into millions, you could lose 99.9% if a few bad years become part of the mix.

3X on the way up is great, but this does not come without the potential of 3X on the way down that could stunt your returns for decades.

For that reason, I have not invested in TQQQ. If you find yourself wanting to dip your toe into the world of leverage, only use money that you can afford to lose.

They can make you rich fast, and broke even faster. A true double edged sword.

~ Cade

Don’t miss the next email 👇

Cade’s Picks

5 Quality Growth Stocks To Buy Now - Joseph Carlson put out another great video on five of his favorite growth stocks to buy now. I love ETFs, but a sprinkle of these could spice up the portfolio.

TQQQ vs QQQ Back Test - Here is the link to a back test of TQQQ vs QQQ over the last 10 years. If you want to experiment with different investing strategies, Portfolio Visualizer is a great tool to see historical performance.

Tools/Software Recommendations From CEOs - Sam Parr runs a group of founders and CEOs called Hampton. In this post he shares the favorite software and tools of Hampton members that aren’t mainstream.

Best Memes

Kind of true tbh.

You need to watch this podcast if you haven’t yet.

What did you think of the content?

Check ‘Em out

Below is a list of featured products I have vetted personally, created, or used. These offers are just for you:

High-Yield Cash Account - Earn 4.1% on your savings

Public - Trade stocks, options, and crypto

Empower - Track all your investing accounts

Bond Account - Earn 7% with investment grade bonds

Money Meals - 15 meal preps under five dollars

Beehiiv - Create your own newsletter

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email don’t hesitate to send me a reply.