If you are not a subscriber, join 4,352 legends who enjoy learning about finance and have a sense of humor.

Also, if this email is appearing in your spam or promotions tab do me a favor and drag it over to your main inbox.

Quote

“We are what we do and say, not what we intend to.” - Kurtis Hanni

Why The 50/30/20 Rule Sucks

In this piece, we are going to take a look at the 50/30/20 budget technique.

While I’m not a huge fan of a strict budget, I do recommend tracking your spending. Making sure your monthly expenses align with the 50/30/20 rule can be a great way to keep your finances in check, but there is room for improvement.

Without further ado, let’s break down this framework, and learn how we can make it even better. 👇

50-30-20 Explained

First things first, each number stands for a percentage of your after-tax income that will be allocated to a certain bucket:

50% Needs - Examples of this are housing, food (not eating out every day), utilities, childcare, transportation, etc.

30% Wants - This is where you get to have a little fun. In the budget world, these would be classified as “non-essential” items. Gym memberships (this is a need for me), vacations, eating out, streaming services, and electronics. Anything you could live without, but is nice to have.

20% Savings - This 20% can be allocated in a number of different ways. If you don’t have an emergency fund, it should go straight to savings until you have at least 6 months of living expenses saved up. If one is in debt, a portion should go to debt paydown.

Assuming both of those are checked off it could be used to buy a few ETFs and start investing (5 ETFs You Need To Know).

Does It Work

As with everything in finance, it depends.

Let’s take two different examples. One median-income earner and one high-income earner. Fiftythirtytwenty.com has a number of different examples applying the 50/30/20 rule, but here is the summary.

Our median income example is going to be based on a married couple with two children in Boise, Idaho. Their annual income is $72,000 leaving them about $4,480 each month after taxes.

Housing costs: $719

Healthcare: $729

Groceries: $782

Transportation: $72

Childcare: $887

Total: $3,189 or 71% on needs.

Source: Fiftythirtytwenty.com

As shown above, for low low-income earners following the 50/30/20 rule can be challenging.

So what about the six-figure players (approx $6,500 a month after taxes)?

50% for expenses - $3,250

30% for wants - $1,950

20% for saving/investing/debt - $1,300

With higher pay, having a living cost that is under 50% of your net income is easier. Now for the curveball.

What if the 50/30/20 rule isn’t enough?

A Step Above

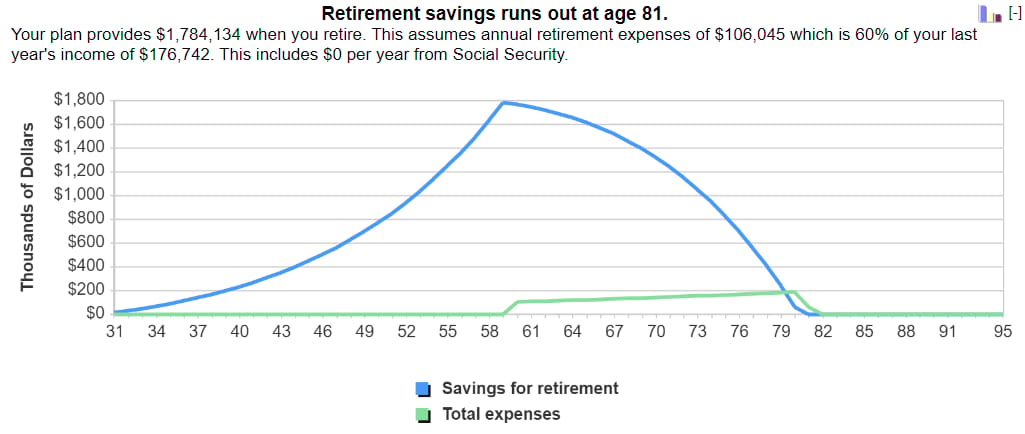

Let’s run the numbers with a retirement calculator. On a salary of $75,000 one will be taking home around $5,000 a month in net income. For this example, we’ll assume the following.

A 20% investing rate, 30 years to invest, 3% annual income increase, investment rate of return before retirement 7%, investment return during retirement 5%, expected inflation 3%.

This plan would result in your having $1,780,000 when you retire (yes, in case you missed it this is adjusted for inflation). Assuming one lives on 60% of their income before retirement, their funds would run out at age 81.

They might still have some gas left in the tank, but their bank account won’t.

How do we fix this?

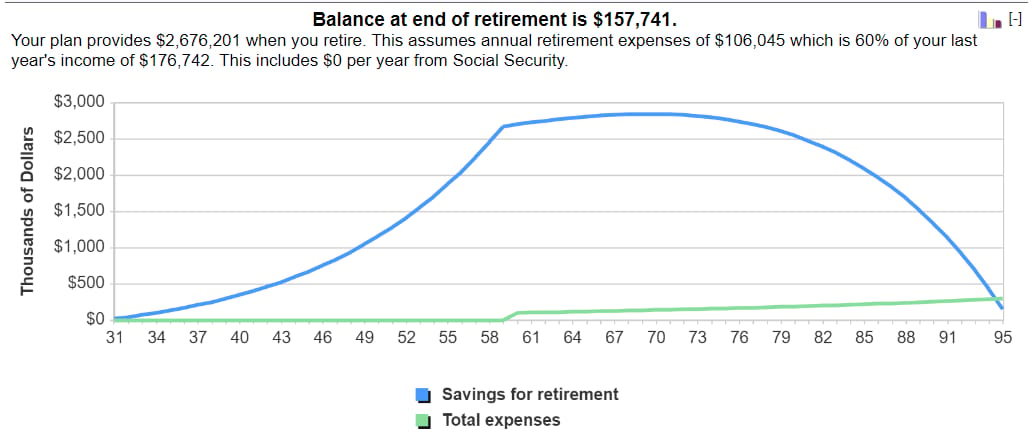

Well, you don’t have to trash the 50/30/20 rule completely. We just need to flip the 30 and 20 rule.

Instead, we are going to put 30% into investments and treat ourselves with 20%. Assuming the same assumptions as above, with this flipped approach we can hope to have $2,600,000 at retirement which would give you plenty to enjoy your glory years at the country club.

Taa-daa.

Conclusion

So, does the 50/30/20 rule actually suck? In all honesty, not really, but it can be made better. As with any financial framework, it’s not bulletproof.

Also, I want to be clear. The purpose of this email isn’t to make you toss and turn at night about how much money you will have at 80 years old. Ideally, we all get rich and have millions of dollars laying around by then.

Though part of having good finances is developing a baseline plan. While the 50/30/20 rule is a great starting point, this example shows that it isn’t all it’s cracked up to be.

50/30/20 is out, 50/20/30 is in.

Till next time, Cade.

Cade's Finds

Why Dividend Stocks Are Falling - Good Youtube video by Joseph Carlson on why dividend stocks are not keeping up with the market and why this is happening.

Retirement Plan Calculator - I’ve linked a lot of these lately, but they are great for building an investing strategy. This is the one used to see how much cash you will have at retirement.

Best Memes

Trung takes both meme places today.

The new Apple Vision Pros dropped this week. Who’s buying?

Funny, but I wouldn’t count Zuck out quite yet.

What did you think of the content?

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email don’t hesitate to send me a reply.