If you are not a subscriber click below to join 5,000+ legends that have a sense of humor and enjoy getting better with money.

Also, if this email is appearing in your spam or promotions tab do me a favor and drag it over to your main inbox.

Yo yo yo it has been awhile! Hope you had a blessed Christmas.

As far as where I’ve been, please accept my excuse…

After years of renting we finally closed on our new house. Over the last two months we have been in the process of doing a few renovations and just recently moving in!

Will do a full post and video on it in the future, but for now let’s get into one of the most underrated investing accounts out there.

Quote

“The opposite of happiness isn’t unhappiness; it’s taking things for granted.” —Mark Manson

If you hate taxes, this is one account you cannot afford to ignore (yes I know that is basically everyone). This little known investing strategy allows your money to go in tax-free, grow tax-free, and come out tax-free

The heart breaking part is most people are don’t even know they are leaving its biggest benefit on the table.

That account is the Health Savings Account (HSA).

Why the HSA Is So Powerful

An HSA offers a rare triple tax advantage: tax-free contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. To qualify, you must be enrolled in a High Deductible Health Plan (HDHP).

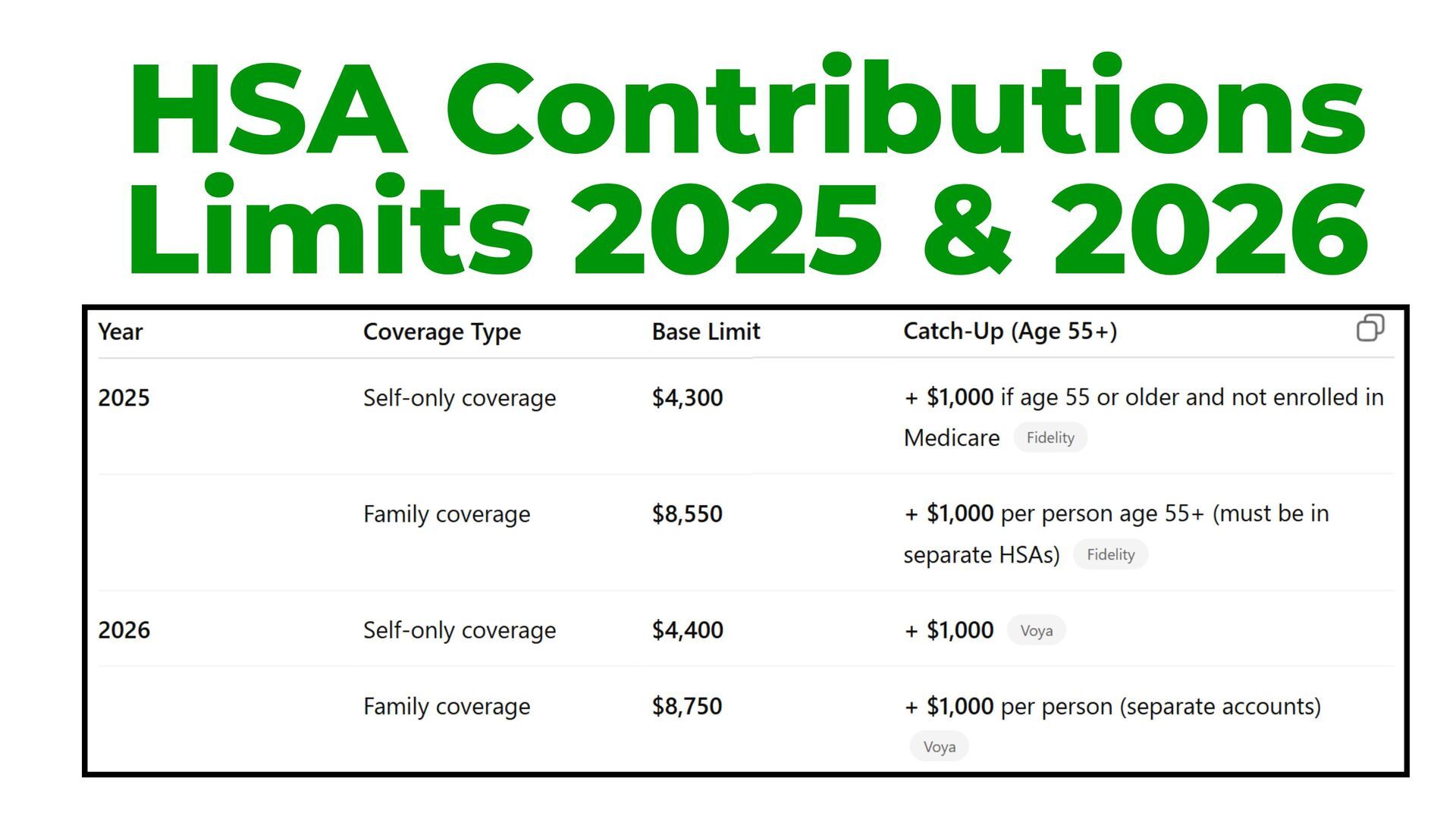

Here is a look at the contribution limits for 2025 and 2026.

The mistake that 91% of people make is that they never invest the money inside their HSA. They treat it like a savings account, missing out on decades of potential compound growth.

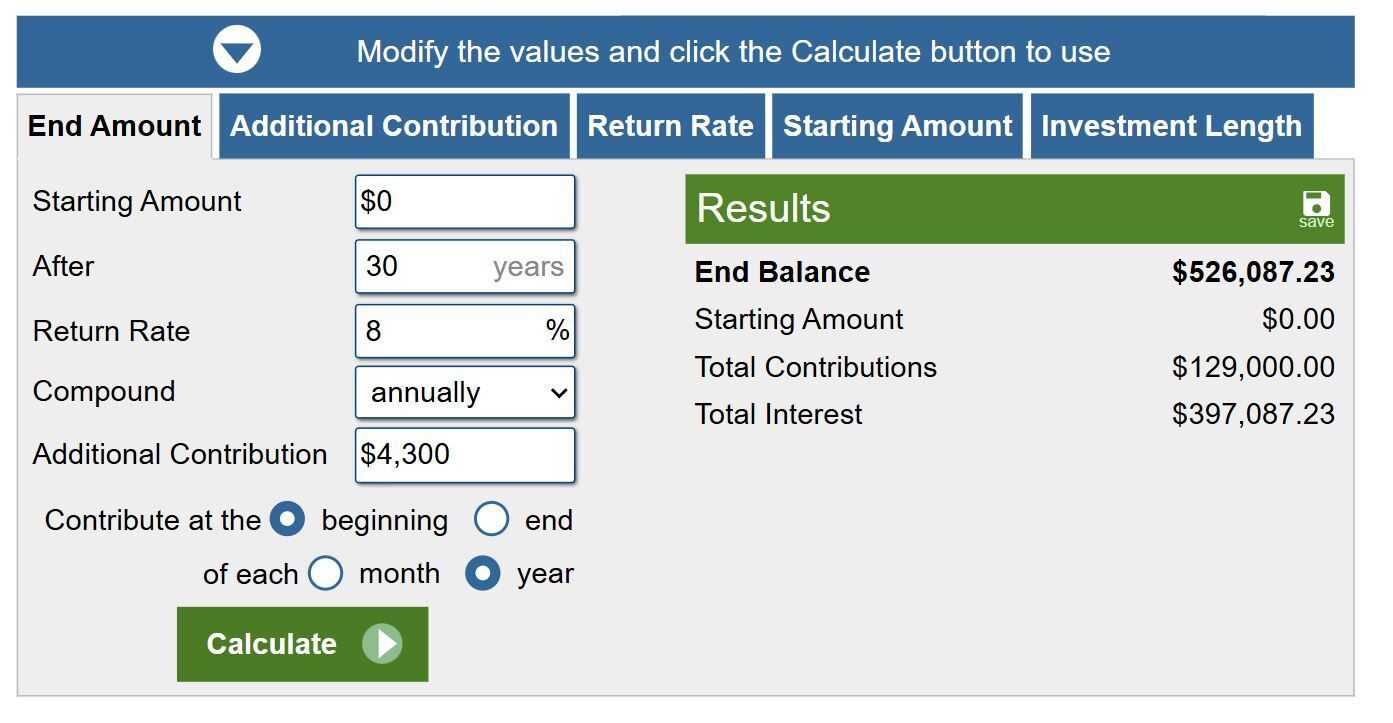

To really put it into perspective…if you maxed out your HSA for 30 years at the $4,300 max (this will go up) you would have $129,000. If you would have invested those same contributions you would have over $520,000 at the end of those 30 years. INVEST IT.

The Optimal HSA Strategy

The most effective approach is simple but powerful:

Invest your HSA contributions (stocks, ETFs, or index funds).

Pay medical expenses out of pocket when possible.

Save and track every medical receipt (link to free tracker).

By doing this, money in your HSA stays invested and compounding while your saved receipts allow you to reimburse yourself tax-free at any point in the future. Even decades later after that nagging shoulder pain has gone away.

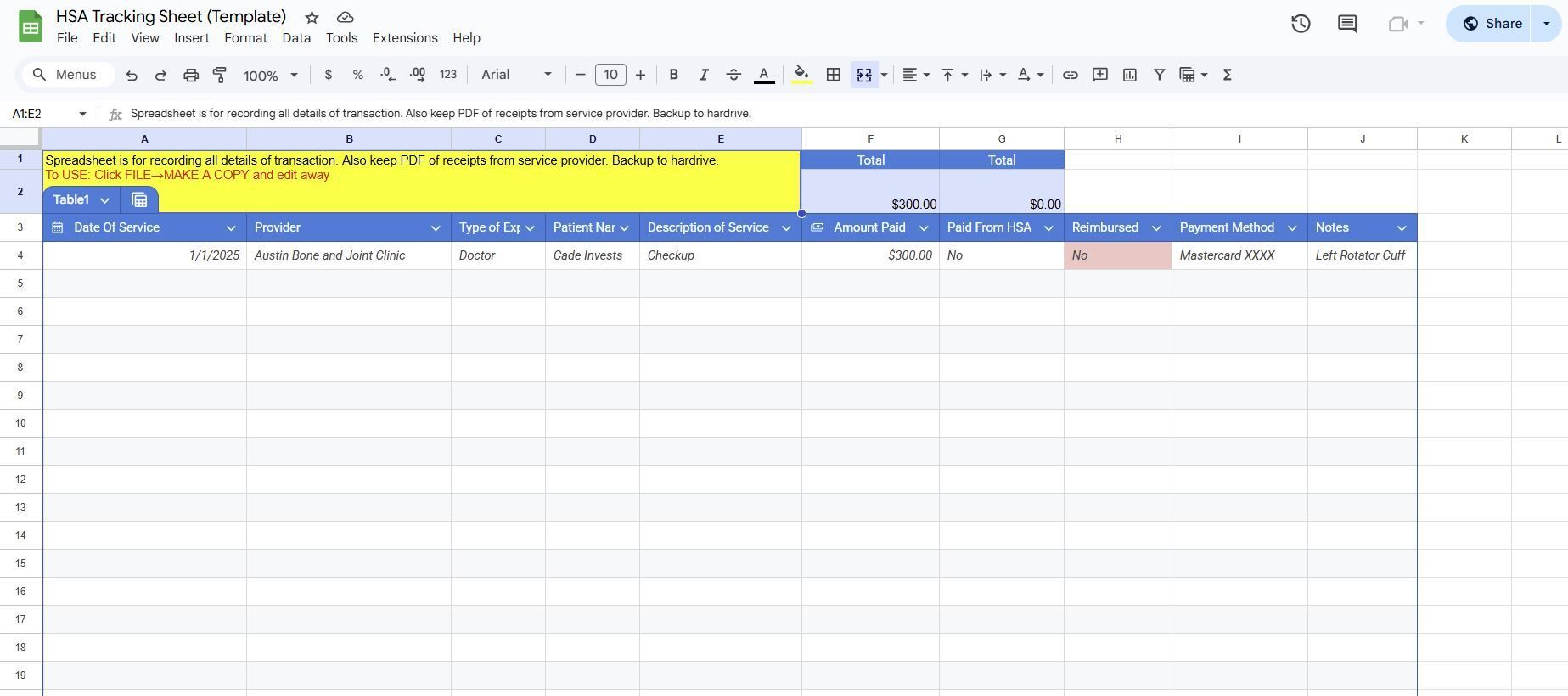

When it comes to tracking your medical expenses (#3) I would recommend saving a PDF copy of your medical receipts and adding it to a google drive folder. You can then easily log it in an HSA tracking sheet to show historical expenses and keep track of when you reimburse yourself.

I’ve created a free google drive template you can download by clicking here.

Conclusion

Of course this all assumes you can cover your medical expenses out of pocket. Do not go into debt paying for medical expenses because you don’t want to pull money out of your HSA (had to get that off my chest).

Over time, this strategy can turn your HSA into a six or even seven figure tax free asset from money you were going to spend on healthcare anyway.

Maybe we should just start calling it the HIA…Health Investing Account. - Cade

(Here is the link if you would like to check out the full video!)

Cade’s Picks

Best Investing Writings of 2025 - Nick Maggiulli posted his annual list of the best investing writing from the last twelve months. Pour a cup of coffee and read through this one morning….worth it.

ChatGPT Hacks To Make You More Productive - We all know AI is here to stay and if you are ignoring it you are just asking to be left behind. In trying to not get replaced by a computer, I’ve started using a few of these hacks in my daily life.

$15K Per Month Flipping Couches - Interesting article about a guy who started a couch flipping business by buying from metro areas and selling the couches in more rural areas. You can make a buck doing anything.

Don’t miss the next email 👇

Best Memes

Son has got to lock in.

Maybe I’m not the next Buffett.

Check ‘Em out

Below is a list of featured products I have vetted personally, created, or used. These offers are just for you:

High-Yield Cash Account - Earn 3.3% on your savings

Get a Stock Mug - Custom designed by your boy

Book a Call - 45min 1on1 with Cade

Public - Trade stocks, options, and crypto

Monarch - Track all your finances in one place

Beehiiv - Create your own newsletter

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email don’t hesitate to send me a reply.