Quick investing update….

I’ve been buying, a lot. On top of my usual monthly contribution I’ve been funneling what extra cash I can into the market. Most of my purchases have been VOO , QQQ, VB, and SCHD.

While I usually don’t do a ton of individual stocks, I have added some AMZN, GOOG, and LMT over the last few weeks.

Shoot me a reply on what you are buying, especially if you think it is a good deal. (;

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.30/share before their share price changes.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Quote

“Spending money to show people how much money you have is the fastest way to have less money.” - Morgan Housel

Opportunity Knocking?

We have good news, and bad news. Which do you want first?

Let’s get to it and start with the negative.

According to the definition the S&P 500 is officially experiencing a market correction (decline of 10%-20%). Your 401k is hurting, and your office neighbor is saying how he is about to sell everything.

The good news is this isn’t the first time a correction has happened.

Let’s take a look three bullish points to remember during corrections. 👇

1) Corrections Are Common?!

In 47% of the years since 1980 the S&P 500 has experienced a drop of 10% or more.

To put it in simple-man terms, it basically comes down to the flip of a coin on if we are going to see a pullback of 10%.

Heads win, tails lose. And that sucker came out tails this year.

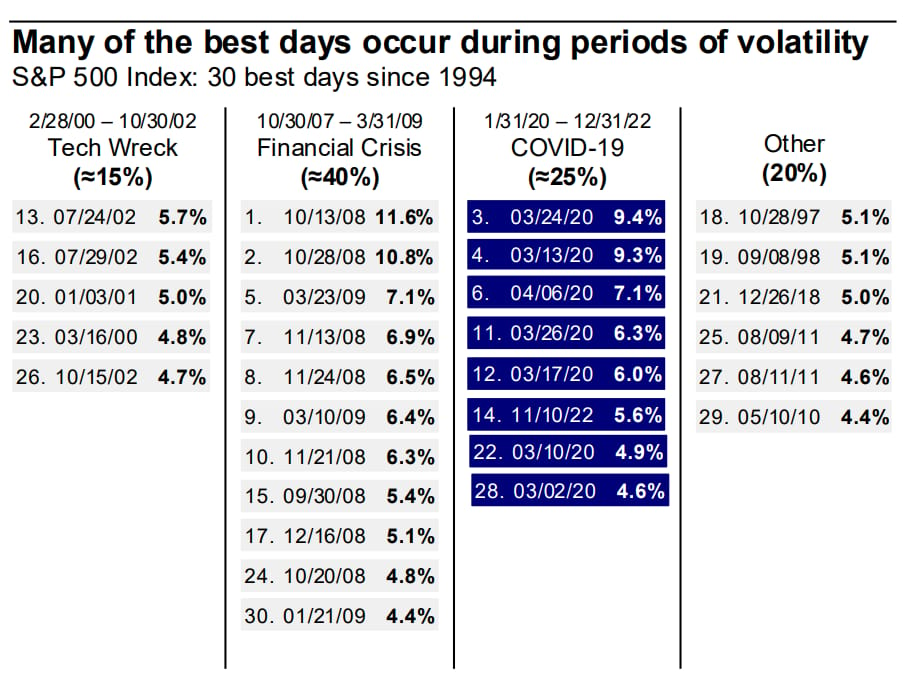

2) The Best Days Closely Follow The Worst Days

While seeing the S&P 500 down 3%+ repeatedly is not a great feeling, it helps to know that according to the numbers, better times are on the horizon.

Here is a chart from Invesco that does a great job of showing how the biggest gains often occur during these times of uncertainty.

3) Recovery Times Aren’t That Bad

We all know you have to keep a long term mindset when investing. 10, 20, 30 years out is what everyone preaches.

You shouldn’t even break a sweat during this correction as the average time to recovery following a downturn of 10%-20% is only eight months according to Bloomberg.

Conclusion

There is an underlying uncertainty surrounding the administration and how tariffs are going to impact the top and bottom line of US companies. While this problem is “different,” according to history this will likely be another blip on the chart in thirty years.

Stick to your plan, don’t make emotional decisions, and if it comes to it - delete your brokerage app.

Thank you uncertainty. We appreciate the opportunity. ~ Cade

Don’t miss the next email 👇

Cade’s Picks

Tesla Earnings Reaction - If you missed it, Tesla absolutely obliterated their earnings. In a bad way. Michael Batnik and Downtown Josh Brown discussed these earnings and what they think is next for the stock during the opening 20min of their pod. If you are a Tesla lover (or hater) it’s worth a watch. Time stamp 3:15-17:20.

Beat Your Phone Addiction - As many of us realize, we probably spend too much time on our phones. I ended up down the rabbit hole of minimalist phones and found this video of Marques Brownless breaking down the features of the Light Phone III. Is this the cure to phone addiction and a potential investing opportunity?

Best Memes

*Deposits another $1,000 in the brokerage.

Horrid earnings, miss on everything?! Who cares.

What did you think of the content?

Check ‘Em out

Below is a list of featured products I have vetted personally, created, or used. These offers are just for you:

High-Yield Cash Account - Earn 4.1% on your savings

Public - Trade stocks, options, and crypto

Empower - Track all your investing accounts

Bond Account - Earn 7% with investment grade bonds

Money Meals - 15 meal preps under five dollars

Beehiiv - Create your own newsletter

Nothing in this email is intended to serve as financial advice. Do your own research. Thanks for reading, if you have any questions, comments, suggestions, etc. about the email don’t hesitate to send me a reply.